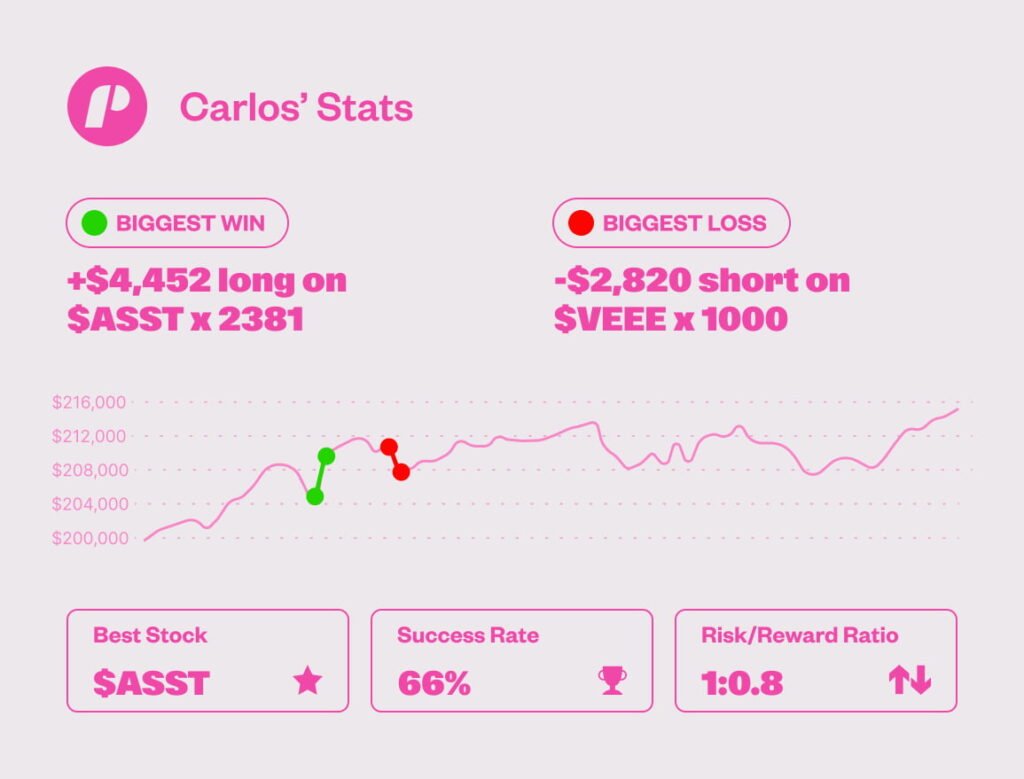

Welcome to another Trade The Pool funded trader spotlight! Today, we feature Carlos R., a $200,000 funded trader from Nicaragua, who passed the Max $200K evaluation on his seventh attempt, earning a $3,100 payout.

Carlos achieved a 66% success rate with a 0.8 risk/reward ratio, shorting small caps with pump-and-dump patterns and leveraging companies with weak fundamentals.

Follow Carlos’ journey from early struggles to payouts—see how he beat overtrading and discovered his trading edge.

Will you be Trade The Pool’s next funded trader?

Watch Carlos’s Interview

“I like the rules of Trade The Pool, for example the fact that you have a daily loss. Thanks to that, I am able to to improve my setup”

Trading Style

Carlos builds his strategy by shorting penny stocks and small caps that spike by 60% or more on hype, often tied to poor fundamentals. He keeps his execution simple—one entry, one exit, no scaling, aiming for clean $1K gains or losses per trade.

Most setups play out the same day or in extended hours, and while he has a 66% win rate, his low 0.8 risk-reward ratio means holding trades for longer to make them work.

What Moved $ASST — May 13, 2025

The sharp price movement in $ASST was primarily driven by legal scrutiny surrounding its SPAC merger, with two separate law firms launching investigations in early to mid-May.

Speculative excitement over a Bitcoin accumulation deal with Strive Asset Management fueled the stock’s earlier rally, priming it for heightened sensitivity to news—and ultimately magnifying its volatility.

More About Carlos

Carlos began trading in January 2024, starting with buy-and-hold large caps, such as Nvidia, but shifted to small caps after a lucky $9-to-$80 trade on Nucleus. Joining Trade The Pool in 2025, he failed six evaluations due to overtrading and poor sizing.

On his seventh attempt, a checklist, smaller share sizes, and the platform’s daily loss limit enforced discipline, resulting in a $15,000 profit in seven days, which surpassed the $12,000 target.

Carlos’ Tips

- On overtrading: “You have to know how to control the risk and how to avoid those kinds of trades that you don’t need to do. You know you don’t need to overtrade, so you have to take care of the good trades—the good setup. But you have to look for your style.”

- The daily pause: “It’s better to take a pause and try again the next day—every day is different. Perhaps you’re having one or two red days, but eventually, you’ll make it. You don’t have to force the trades; you have to be patient. Thanks to that, I was able to improve my setup.”

- Strategize with the demo: “Use a demo account paper trading… watch the charts the whole day and try to simulate that, like if you are trading, and see if your trade was right or not.”

Funded Trader, Carlos R. – Closing Thoughts

Trade The Pool’s shorting capabilities and risk controls allowed him to execute his pump-and-dump strategy, unlike his previous broker.

Studying small-cap patterns since January 2025, he now treats trading as a business, focusing on patience and risk management to sustain his $3,100 payout and build a long-term career.

If you liked this post make sure to share it!