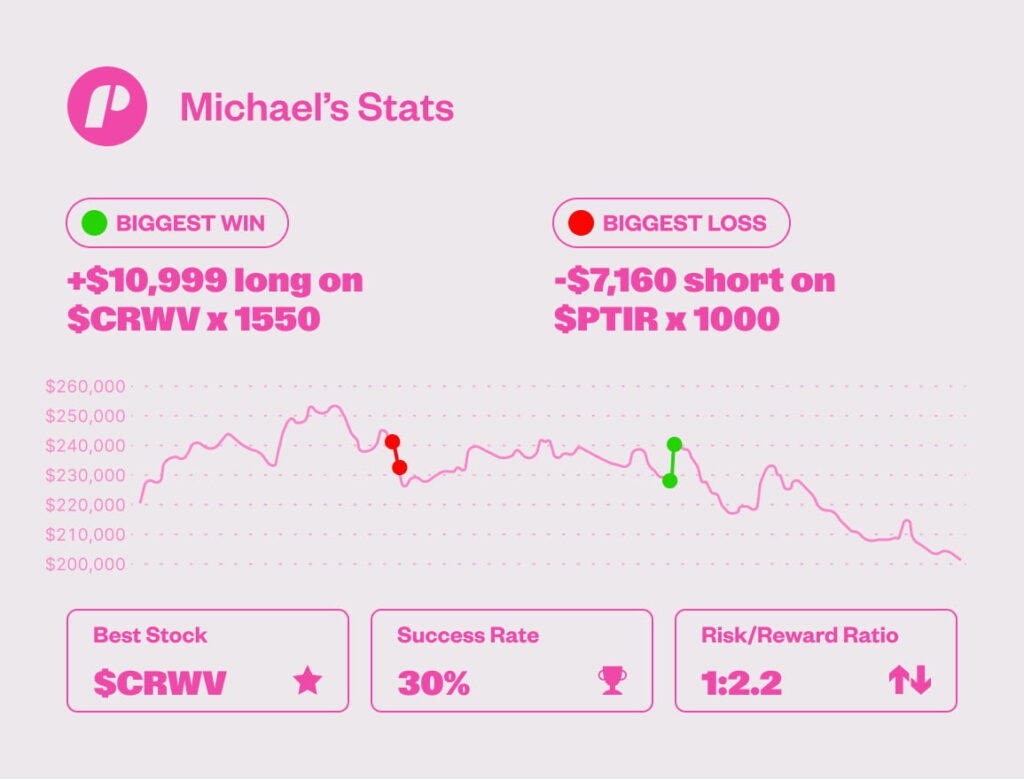

Welcome to another Trade The Pool-funded trader interview! Today, we’re joined by Michael T., a returning guest who has successfully scaled a $200,000 funded account three times and received $75,350 in payouts.

Michael’s winning strategy involves trading between large caps and small caps, focusing on breakouts and pullback buys, with a 30% success rate and a 1:2.2 risk-to-reward ratio.

Take a look at his approach, which utilizes price action, volume, and news catalysts to enter trades in stocks like $CRWV and $APLD.

Will you be Trade The Pool’s next funded trader?

Watch Michael’s Interview

“Trade the Pool definitely offers an opportunity that really no other online prop firm I’ve seen offers”

Trading Style, Michael T.

Michael Day trades large caps for longer consolidations and small caps for shorter flags on news. He risks $1-$3 per trade, cuts losses fast, and scales in after cushions form. Position sizes range from 1,000 to 3,000 shares, with a $200,000 buying power, targeting 10-20% movement.

His biggest win came from a long position in $CRWV, with 1,550 shares, yielding a profit of $10,999. His most significant loss was a short position in $PTIR, with 1,000 shares, resulting in a loss of $7,160. Additionally, he supplements his portfolio with swing trades in his personal account.

What Moved $CRWV, Week of May 27, 2025

$CRWV surged 20.7% on May 27, 2025, to $123.97 after Barclays downgraded the stock and analysts raised concerns about its valuation. Volume hit 38.0M shares. The rally was news-driven, with investor rotation despite warnings that the stock may have peaked.

More About Michael

Michael started trading 13 years ago in college with an S&P 500 ETF. His first win turned $7,000 into $40,000 on MJNA via a 700% surge.

He balances his 9 to 5 account job and trading with Trade The Pool, and does so successfully.

Michael’s Tips

- Diversify your setups: “By being open to large and small caps, you’re allowing yourself to find higher quality trades when certain trading setups might not be the best time for it. I don’t have to trade small caps every day.“

- Sizing and emotions: “When I start trading too big of a size, that’s where you get emotional, you end up taking a bigger loss when it could have been a green trade. I think I trade the most consistently with sizing in a band of $1-$3 risk.“

- Trade and learn: “I personally believe the best way to learn is also to get out there and trade. Get some skin in the game. [Trade The Pool] has a ton of educational resources.”

Funded Trader, Michael T. – Closing Thoughts

Michael’s accomplishments are more than numbers; they’re proof that a winning strategy is not enough; it must be paired with consistency and discipline. If you’re ready to write your own trading success story, take a page from Michael’s playbook, and maybe you’ll be our next featured funded trader.

If you liked this post make sure to share it!