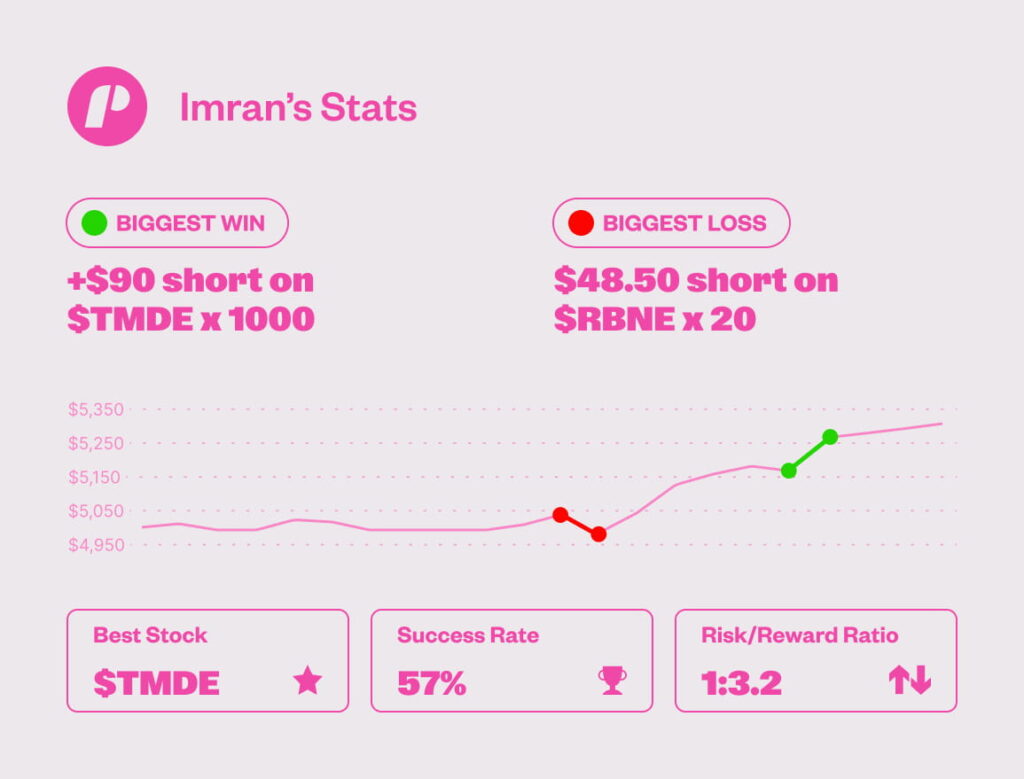

Welcome to another Trade The Pool-funded trader interview! Today, we feature Imran, a stock trader from the United Kingdom, who passed the $5,000 MAX evaluation.

Imran achieved a 57% success rate and a 3.2 risk-reward ratio by trading small caps using price action near whole numbers and psychological levels, combined with news bias.

Discover Imran’s simple shorting strategy, emphasizing cutting losses quickly, and scaling in only after building enough cushion.

Will you be Trade The Pool’s next funded trader?

Watch Imran’s Interview

“If you develop a passion for trading, and you got the skills, Trade The Pool is there to make it happen “

Trading Style

Imran trades small caps, microcaps, and low float stocks, focusing on price action, relative momentum, and news bias. He shorts in pre-market on extensions or fluffy news, using stop-limits to cap losses, and avoids regular hours shorts due to high volatility.

For longs, he enters in regular hours on lower timeframes near whole numbers. He scans top gainers, sets alerts for key levels, and scales out 5-10% on winners.

What Moved $TMDE— June 13, 2025

TMDE jumped 75.2% on June 13, 2025, after reporting $688M in revenue and announcing a move into solar tech. Volume hit 84.8M shares. The rally was primarily driven by news, with earnings and expansion reports.

More About Imran

Imran developed an interest in the markets during the COVID-19 pandemic, initially practicing on paper and managing small accounts of £200-£300. However, family and job commitments limited his focus, affecting his consistency.

Last year, he continued to work on his strategy. After 6 months with Trade The Pool, he shifted from chasing pre-market news to regular hours trading and adding pre-market shorts. Ultimately, he is grateful for Trade The Pool’s built-in risk management mechanism.

Imran’s Tips

- On price action: “I make my trade based on price action. On lower timeframes, see levels near whole numbers, psychological points, and overall relative momentum. I carry some bias from the news.”

- On scaling: “I cut losses quickly, no matter what. Once I get a cushion, I go for two to four times the normal trade amount on conviction setups.”

- On topping small caps: “Micro caps don’t listen to anyone, they go to any highs. Use stop-limits to cap losses.”

Funded Trader, Imran S. – Closing Thoughts

Imran’s story proves that passion and determination can conquer barriers. His future plan is to shift to mid-cap stocks, which offer greater buying power.

“Never give up,” Imran advises.

If you liked this post make sure to share it!