“Trade The Pool minimizes your own downside. It just makes a lot more sense”.

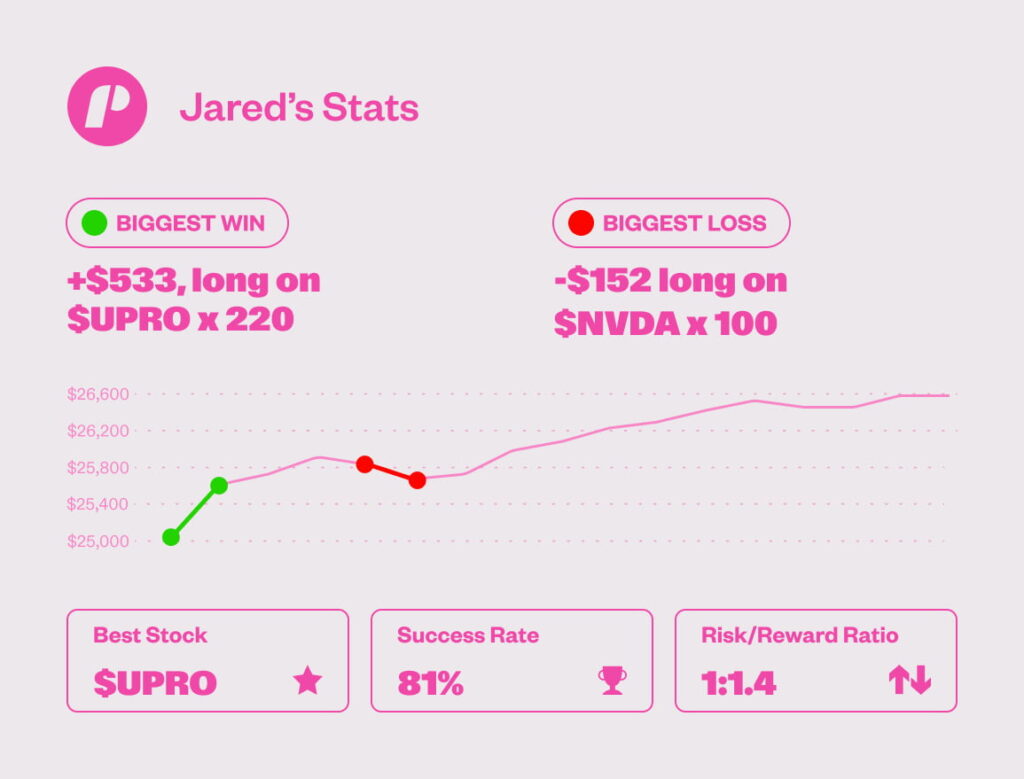

Welcome to another Trade The Pool funded trader interview! Today, we have Jared L, a $25,000 funded trader from the USA.

Jared passed his evaluation in just two days! He credits Trade The Pool for minimizing his risk, allowing him to trade with more conviction and confidence.

Learn his strategy and how he overcame challenges, including trading with ADHD, in his inspiring journey below.

Will you be Trade The Pool’s next funded trader?

Watch Jared’s Interview

Jared’s Trading Style

Jared focuses on clean charts with minimal noise. He uses VWAP for breakout and breakdown setups, targeting entries after retests or pullbacks.

He monitors trends on 5-minute, 15-minute, and 4-hour charts to identify profit and scaling opportunities. Furthermore, he sticks to familiar tech stocks, studying daily charts to spot strong or weak movers aligned with market sentiment.

What Moved ProShares UltraPro S&P500 ($UPRO)

On April 9, 2025, markets rallied dramatically following President Trump’s 90-day tariff pause, with the Dow rising 7.9%, the S&P 500 9.5%, and the Nasdaq 12.2%.

More About Jared

Jared trades familiar large-cap tech stocks like Apple, Nvidia, AMD, Amazon, and Google, leveraging his deep understanding of their price movements and swings to anticipate trends effectively.

By focusing on a structured strategy and clear risk management, he turns his diagnosed ADHD into a non-issue, and passing the challenge within two days is the ultimate proof of it.

Jared’s Tips

- Trading familiar stocks: “I find it much easier to trade stuff you’re familiar with how they move. So you don’t get caught off guard nearly as much. It’s already so difficult. And you just want to be the best version of you when you’re trading.”

- What contributed to the high win rate: “I think I had a pretty good read on what the market was going to do. On the day that a lot of that profit came from, I really felt that the market was going to squeeze and continue to squeeze for the rest of that day. So I felt very comfortable holding my long, longer than I normally would.”

- VWAP retest strategy: “I like to see a long retest VWAP and come back up, and I feel a lot better about a breakout on the second attempt once it’s already retested the lows, put in support, and I find that a good entry after that pullback. Same with breakdowns—I like to see it come down to the low of the day, and normally if it’s under VWAP, I’ll feel good about that short.”

Funded Trader, Jared L. – Closing Thoughts

Jared’s journey proves that trading familiar stocks and strategy consistently drives higher success rates in the markets.

He showcases how Trade The Pool is the ideal platform for all traders to test strategies that work for their own situation, with minimal risk and a higher degree of confidence to trade.

If you liked this post make sure to share it!