Oracle Corporation is in the midst of frenetic deal-making that could essentially reshape its role in the world markets. With ongoing advanced discussions to purchase TikTok’s U.S. operations, Oracle’s partnership with the social media firm raises essential questions: How will the deal mitigate national security concerns? What are the downsides and upsides to Oracle stock price performance? – Oracle’s shift to the cloud and intensifying competition within the database sector present significant hurdles, which compel us to assign the firm a High Uncertainty rating. These concerns bring about higher volatility in our top-line forecasts. Historically, Oracle sold its database software through licensing arrangements. As the partnership with TikTok unfolds, investors, technology enthusiasts, and legislators eagerly scan for the promise of potential threats and opportunities to Oracle’s share price movement that could make this one of the biggest business deals of the decade.

Utilizing a stock trading program can help investors track these developments in real time and make informed decisions. This article examines Oracle’s role in TikTok’s American operations, the key dynamics driving the negotiations, and the broader implications for investors seeking to assess the stock’s potential. From Project Texas 2.0 to Chinese government sign-offs, every aspect of this partnership intersects with market volatility and regulatory uncertainties.

Key Notes

-

- Advanced Talks with the White House

- ByteDance Stock Price and Security Concerns

- Political Dynamics and Deadlocks

- Investor Sentiment and Stock Market Impact

- Potential Upside for Oracle Stock Price

- Tech Governance and Data Security

Oracle Stock Price: Advanced Talks with the White House

Oracle’s bid for TikTok’s U.S. business is a strategic move aimed at addressing long-standing national security concerns. Vice President JD Vance and National Security Adviser Mike Waltz have been leading negotiations with Oracle, a sign of the administration’s commitment to American user data security. The takeover’s mission is straightforward: to ensure that U.S.-based data is inaccessible to Chinese entities, thereby rendering concerns about surveillance or abuse null and void.

For investors, Oracle’s advanced discussions are an opportunity for the firm to enhance its reputation as a trusted technology partner. However, the talks also come with significant risks as the national security spotlight invites greater scrutiny of Oracle’s motives and capabilities.

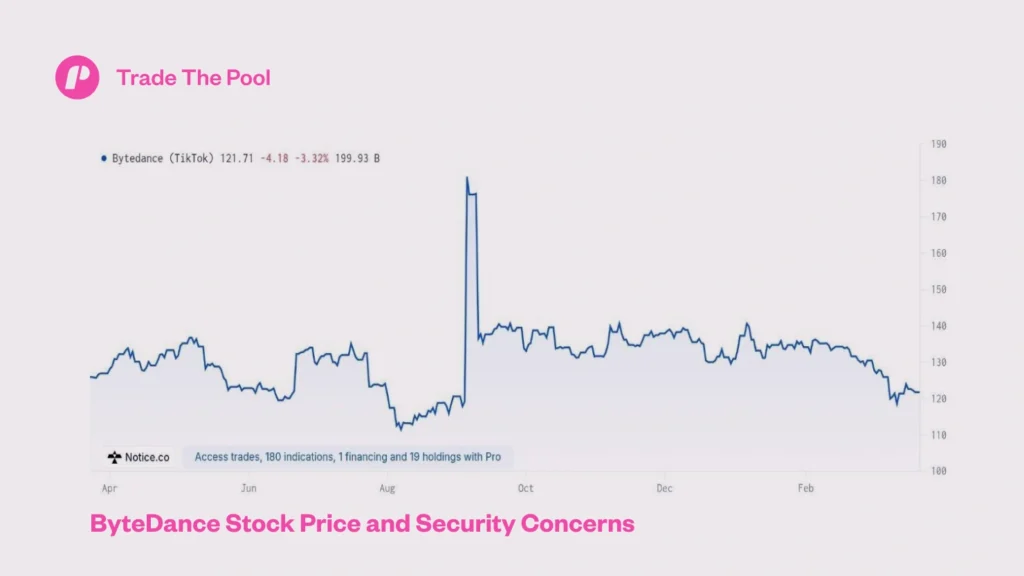

ByteDance Stock Price and Security Concerns

Despite Oracle’s involvement, there are still grave concerns about ByteDance maintaining control over the TikTok algorithm. While Oracle’s cloud hosting would store U.S. user data, the fact that ByteDance retains ownership and control of the platform’s core algorithms is troubling. Critics argue that even when data is housed on U.S. soil, algorithmic control could allow the Chinese government to leverage TikTok’s activities to acquire sensitive information or manipulate content.

For shareholders of stock, these concerns identify a central risk factor. Regulatory decisions controlling the role of ByteDance may lead to greater scrutiny, market volatility, and uncertainty for the Oracle share price. This highlights the importance of maintaining close attention to developments in this regard when looking at Oracle as a potential investment.

Project Texas 2.0 and Security Focus

Project Texas 2.0 is an extension of Oracle’s earlier pledge to move American users’ data to secure servers in Texas. However, the effort has thus far stopped short of Congress and the Biden administration’s national security fears about TikTok’s connection to China. Lawmakers are concerned that data protection guarantees would be empty if ByteDance retains a significant level of control, leaving Oracle in a difficult position to make guarantees to stakeholders.

For investors, Project Texas 2.0 is a double-edged sword. On the one hand, it reflects Oracle’s ability to tackle regulatory challenges and ink top-level partnerships. On the other, the ongoing spotlight and failure to reach an accord may limit investor confidence in Oracle’s growth opportunity. For those looking into the best stocks for beginners with little money, understanding these dynamics is crucial, as it highlights the importance of evaluating both opportunities and risks in potential investments.

Political Dynamics and Deadlocks

TikTok politics have been a source of intrigue and bewilderment. The then-President Donald Trump signed an executive order delaying the implementation of Congress’s ban on TikTok, demanding the divestiture of its U.S. business by April 5. Oracle founder Larry Ellison’s close ties to influential Washington, D.C. personalities, including Trump, have fueled speculation that the company leveraged political clout in securing the deal.

However, political considerations also muddle Oracle’s foray. Multiple bidders, including other technology companies, are reportedly competing to acquire TikTok’s U.S. business, making the process competitive and fluid. For traders, the shifting dynamics could translate into abrupt market reactions as negotiations take place.

Capitol Hill Scrutiny and National Security Implications

Staffers on Capitol Hill are closely monitoring Oracle’s proposals to ensure compliance with U.S. laws. Lawmakers have expressed worry that Oracle may not be in a position to entirely rid the national security risks inherent in ByteDance’s continued involvement in TikTok’s algorithm. The high-risk agreement puts Oracle’s reputation and stock performance under scrutiny.

To investors, it matters to know the outcome of this analysis. A favorable result would reinforce Oracle’s market position, and outstanding problems can adversely affect investor sentiment and contribute to volatility.

Investor Sentiment and Stock Market Impact

Oracle’s potential agreement with TikTok has drawn mixed investor responses, with both hope and caution being raised. The recent events have already impacted Oracle’s stock price, with market volatility highlighting the sensitivity of this high-profile alliance.

Market Reaction to Oracle Stock Price

Following news of Oracle’s advanced talks with TikTok, the company’s stock price declined by approximately 3%. The drop highlights investors’ concern regarding the risks involved in the partnership, including regulatory risks, public outcry, and ByteDance’s continued involvement.

Investor Caution: ByteDance and TikTok Stock Prices

Investors are waiting for Oracle to address the following key concerns:

- Data Security Assurance: It is critical to ensure that U.S. users’ data is entirely secure from foreign access to regain confidence.

- Regulatory Compliance: Oracle must demonstrate its capability to satisfy U.S. government requirements while managing ByteDance’s algorithmic ownership.

- Political Volatility: Since the deal is pending Chinese government approval and remains under scrutiny on Capitol Hill, investors are bracing for potential delays.

To become a successful stock trader, understanding these key concerns is essential. By closely monitoring Oracle’s ability to address data security, regulatory compliance, and political volatility, traders can make informed decisions and navigate the market’s complexities effectively.

The uncertainty of the TikTok discussions has made Oracle’s stock a top choice for traders seeking to balance risk and reward.

Potential Upside for Oracle Stock Price

If Oracle secures the deal for TikTok’s U.S. business and receives approval from both the U.S. and Chinese governments, the stock is expected to see significant growth. Some of the biggest opportunities for Oracle include:

- Strengthened Cloud Business: Hosting TikTok data would further solidify Oracle’s position in the competitive cloud computing market.

- Market Credibility Boost: Successfully navigating such a complex, high-profile deal would give Oracle a boost in credibility as a global technology giant.

Broader Implications for Share Traders: Oracle, ByteDance, and TikTok Stock Prices

Oracle’s agreement with TikTok has broader implications than the company itself. Share traders must consider how the deal might shift the competitive landscape for the tech giants and the direction of global markets.

Effect on Key Rivals: Oracle and TikTok Stock Prices

If Oracle secures TikTok’s U.S. operations, it could disrupt the market equilibrium for competitors like Instagram Reels (Meta) and YouTube Shorts (Alphabet). The unabated growth of TikTok under Oracle’s ownership may divert advertising revenue and user time from these platforms, potentially harming their respective stock performances.

Tech Governance and Data Security: ByteDance and TikTok Stock Prices

This partnership highlights the growing importance of data security across borders and regulatory compliance in tech governance. For stock traders, understanding these shifting dynamics is crucial in determining opportunities and risks in the technology sector.

Forex trading, which involves the exchange of currencies on the foreign exchange market, can significantly influence forex stock prices. The value of a company’s stock can be affected by fluctuations in currency exchange rates, especially if the company operates internationally. For instance, if Oracle’s partnership with TikTok leads to increased revenue from international markets, changes in forex rates could impact the overall profitability and stock price of Oracle. Traders must consider these forex dynamics when evaluating the potential risks and opportunities in the technology sector.

Global Market Sentiment: Oracle, ByteDance, and TikTok Stock Prices

The outcome of Oracle’s deal with TikTok could set a precedent for how governments handle data privacy and foreign ownership in the digital age. If the deal is successful, it could encourage other companies to pursue similar partnerships, but failure could lead to tighter regulations and increased scrutiny for tech companies.

Conclusion: Oracle Stock Price and TikTok Acquisition

Oracle’s advanced discussions to acquire TikTok’s U.S. operations represent a pivot in the company’s strategy. For equity investors, the partnership presents both opportunities and risks that must be balanced against regulatory risks, market sentiment, and competitive factors. While the potential upside—new cloud revenues and market credibility—seems significant, the unknowns of national security and political approval cannot be disregarded.

As things continue to develop, traders must remain vigilant, leveraging both technical and fundamental analyses to inform their investment decisions. Oracle’s TikTok experience is a fascinating case study on navigating the dynamics of modern tech partnerships and their influence on stock market operations.

If you liked this post make sure to share it!