Introduction

This is the second part of our two-part article on Dark Pools. In the first part, we discussed the Dark Pool meaning, explained how Dark Pool trading works, and even had a quick glance at the main types that exist and the protagonists and major players. In this second part, we aim to answer the question “Can retail traders benefit from Dark Pools?” and discuss dark pool indicators.

(If you miss the first part, you can read it here)

Let’s give it a go!

Key Notes

Amongst the main obstacles that stop small account traders from operating in Dark Pools are:

- Small account

- Dark Pools are focused on institutions

- The technological requirements and know-how

- Higher fees

- Regulatory concerns

As we previously said…

As we found out in the first part of the article, retail traders generally do not have direct access to dark pools unless they are lucky enough to manage huge trading accounts.

Dark Pools are primarily used by institutional investors and high-frequency traders (HFTs) to execute large block trades anonymously and – as we’ve also discussed – there are several good reasons why this is the case.

The three most important of these reasons are:

- Institutional Focus

Dark pools cater to institutional investors who need to trade large blocks of stocks without impacting the market price. Usually, retail trades have much smaller accounts and would not be a good fit for the pool’s liquidity needs. - Technological Requirements

Accessing dark pools often requires advanced technology and high-speed order routing systems, which are not readily available to retail investors. - Regulatory Concerns

Regulators are concerned about potential market manipulation and lack of transparency in dark pools. Allowing retail access could exacerbate these concerns even further.

How can small retail traders benefit from Dark Pools if they can’t even get access to them?

Firstly, let’s clarify that despite retail traders being excluded from directly trading in Dark Pools, there are a few ways they can gain access to them “indirectly”.

Some brokers, for example, offer access to their own internal Dark Pools, where retail orders can be matched with institutional ones. There is also the option offered by Electronic Communication Networks platforms (ECNs) that facilitate anonymous trading between multiple participants, including retail investors (however, they may not offer the same level of anonymity and price improvement as true dark pools). Finally, a retail trader may opt for a third-party platform, some of which offer limited access to Dark Pool (but expect a different set of fees and restrictions to be applied).

It is also important to note that the existence of Dark Pools also offers benefits that are indirect and may not be readily apparent to individual retail traders. For example, the presence of dark pools can contribute to a more efficient and liquid market, which can ultimately benefit all investors.

For traders, however, the greatest advantage lay in the information Dark Pools’ price action can provide.

Let’s find out more.

Dark Pool Indicators

Although not able to trade directly in Dark Pools, some traders have nonetheless learned to use Dark Pool indicators and incorporate them as part of their trading strategy.

Dark Pool Indicators are tools used to gain a deeper and more insightful perspective into trading activity outside of the open market.

Traditionally, most of the Dark Pool Indicators focus on data such as Dark Pool volume and Dark Pool volume compared to the total volume (which indicates the actual and potential impact of Dark Pool trading activities on market prices), liquidity (often represented by the bid/ask spread within the dark Pools), and the divergence between the dark pools and the open market price.

Let’s take a quick look at some of the most popular Dark Pool indicators.

Key Notes

The most popular Dark Pools indicators amongst traders are:

- DIX

- DPP

- DPD

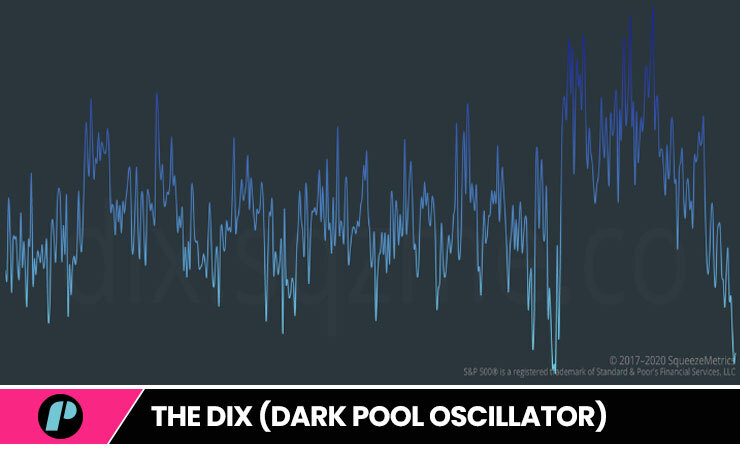

The DIX

(Dark Pool Oscillator)

The DIX is a technical indicator used to measure the difference between the price action of the S&P500 in a dark pool and its price action in the public market.

The DIX measures the divergence between the price action in the dark pool and the public market and it’s commonly interpreted as follows:

A Positive DIX indicates that the S&P500 is trading at a higher price in the dark pool than in the public market. This can suggest that large buyers are accumulating shares or that sellers are clearing out their positions discreetly.

A Negative DIX: Indicates that the same security is trading at a lower price in the dark pool than in the public market. This can suggest that large sellers are unloading shares or that buyers are waiting for a better entry point.

A Zero DIX indicates that the price action in the dark pool and the public market is in sync.

The DPPs

(Dark Pool Prints)

DPPs refer to the executions of trades in a dark pool. They provide traders with real-time information about the size, timing, and price of trades.

DPPs can be categorized into “lit prints” and “dark prints.” Lit prints are trades that are displayed on public exchanges while dark prints are trades that occur entirely within the dark pool.

By monitoring DPPs, traders can assess the liquidity and price impact of dark pool activity.

The DPD

(Dark Pool Depth)

DPD measures the amount of orders that are resting in a dark pool at a given price level.

This information helps traders gauge the potential liquidity available for execution. High DPD at a particular price level indicates a greater probability of successful trade executions.

The DPV

(Dark Pool Volume)

DPV represents the total volume of trades executed in a dark pool over a specified period of time.

High DPV indicates high liquidity and potential opportunities for traders to participate in bulk trading.

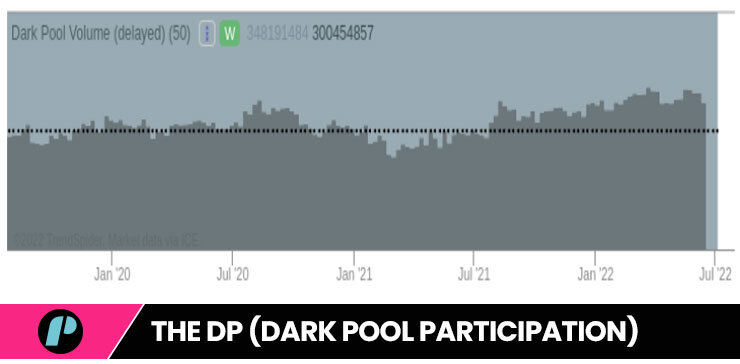

The DP

(Dark Pool Participation)

DPP measures the proportion of a trader’s order that is executed in a dark pool.

High DPP suggests that the trader has strong relationships with dark pool participants and can access favorable pricing.

The DPL

(Dark Pool Latency)

DPL measures the time lag between the submission of an order to a dark pool and its execution. Low DPL indicates faster execution speed and reduced risk of information leakage.

The DPV

(Dark Pool Volatility)

DPV measures the volatility of prices in a dark pool.

High DPV suggests that the market is experiencing significant price fluctuations, which can pose risks and opportunities for traders.

The DPA

(Dark Pool Analysis)

DPA involves analyzing historical and real-time data from dark pools to identify patterns, trends, and anomalies. This information can help traders develop sophisticated trading strategies and make informed decisions.

Conclusion

Although as we learned there are way too many barriers for small account holders to trade directly into Dark Pools, knowing how to interpret Dark Pools data and indicators can grant everyone -including you – an enormous advantage in their everyday trading.

By monitoring DIX, DPPs, DPD, DPV, DPP, DPL, DPV, and DPA, you can gain insights into liquidity, price impact, execution speed, and market dynamics which could enable you to gain a better and more complete perspective on the market.

Indicators like these (and the many more that exist) could further empower you to make better-informed decisions and maximize your opportunities in the stock market so don’t underestimate them.

Hope this helps.

If you liked this post make sure to share it!