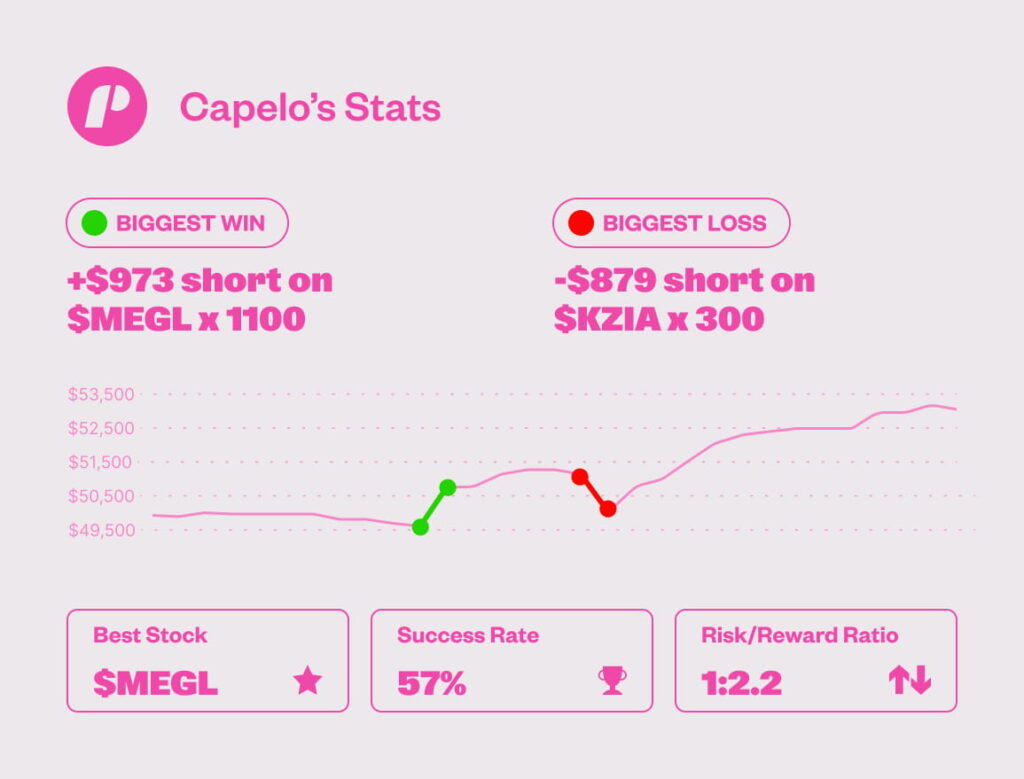

Welcome to another Trade The Pool funded trader interview! Today, we feature Capelo, a veteran trader and mentor from Spain, who passed the Flex evaluation on his first attempt in one week, now funded with $50,000.

Capelo achieved a 57% success rate and a 2.2 risk/reward ratio, shorting small-cap stocks that gap up 100%+, targeting the first red candle for precise entries.

Discover Capelo’s simple shorting strategy that got him funded, honed by years of experience trading other assets such as Forex and Futures.

Will you be Trade The Pool’s next funded trader?

Watch Capelo’s Interview

” I tried everything, Forex and Futures. I focus on small caps, and it’s easier to find an edge with stocks”

Trading Style

Capelo is a short seller focusing on small-cap stocks with 100%+ pre-market gaps, driven by news or momentum. He enters on the first significant red candle, what he calls a “point of no return”, using price action and volume, avoiding trades after 11 AM.

He is careful with oversizing, and closes trades near market open (9:30-10:00 AM) for more optimal gains. Tradervue journaling gives introspect about his entries, yielding a good success rate and risk-reward ratio.

What Moved $MEGL— June 12, 2025

During the week of June 12, 2025, MEGL’s movement was a classic case of low-float volatility, where momentum and technical setups, not fundamentals, drove price action. No news, just chart setups and volume spikes.

More About Capelo

Capelo traded futures and forex but found the opportunities there to be severely lacking or too limiting and difficult. Eleven months ago, he shifted to small-cap stocks, turning $1,500 into $32,000 in April 2025. Overconfidence led to $6,000-$8,000 daily losses in May from oversizing positions, a lesson in discipline.

His YouTube channel, CapeloTrading, mentors a global community with insights on shorting and risk management. Trade The Pool’s 12,000 stock symbols and daily loss limits supported his strategy, allowing endless shorting opportunities without personal capital risk.

Capelo’s Tips

- Timing short entries: “I wait for the first sign of weakness. You can say it’s like the very first red candle. It’s big enough. And of course, it has to be after a huge run-up, like maybe a hundred.”

- Avoid late-day small cap risks: “If it’s after eleven AM, I will try to avoid shorting. If it’s not a first day gapper, it’s not my need.”

- Advice for new traders: Master One Side First: “I would recommend to start with one thing. And then once you are really good at it, like shorting, then change to the other.”

Funded Trader, Capelo – Closing Thoughts

Capelo is a veteran trader and a mentor for many. He truly believes there are easier opportunities to find in stocks, specifically, small caps, compared to Forex and Futures.

He aims to make around $4,500 a month with his new funded account.

If you liked this post make sure to share it!