Welcome to another Trade The Pool-funded trader spotlight! Today, we have Aneury, a funded stock trader from the Netherlands Antilles, who passed the $25,000 FLEX evaluation.

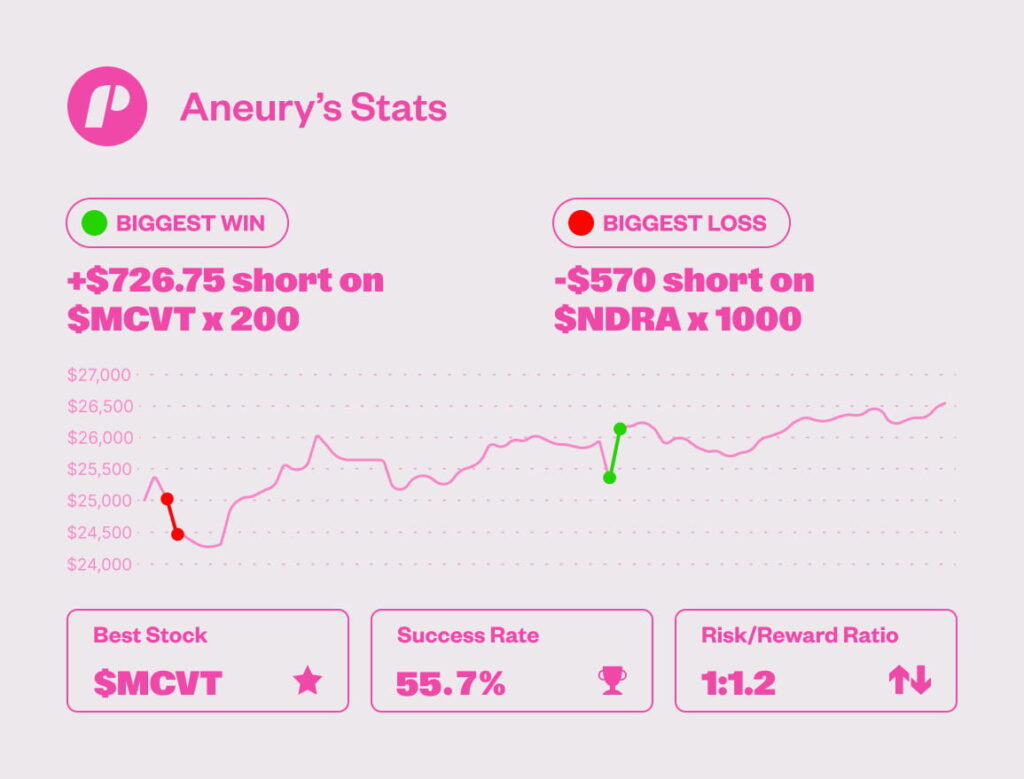

Aneury achieved a 71.43% success rate with a 1:1.2.2 risk-reward ratio by trading small caps during premarket hours, using momentum to his advantage.

Check out how he was able to fade volatile stocks, what’s the truth behind his strategy, and other patterns and conditions he looks for.

Will you be the next funded trader at The Pool?

Watch Aneury’s Interview

“I reached the daily pause and that’s one of the most beautiful mechanism that you guys have. It protects and works with you, not against you.”

Trading Style

Aneury shorts small caps post-surge, holding trades from market close to the next open, averaging five hours. He uses a ten-tick ($0.10) rule, exiting on fading volume or support breaks. Dynamic stop losses and profit targets, guided by candlestick patterns, keep risk at $100 per trade.

His biggest win was a $726.75 short on $MCVT with 200 shares, while his most significant loss was $570 on $NDRA with 1,000 shares.

What Moved $MCVT— Week of July 28, 2025

During the week of July 28, 2025, $MCVT surged over 200% amid speculative fervor and elevated trading activity, driven by enthusiasm for its newly unveiled high‑yield loan program. A scarce float and heavy insider ownership created ideal conditions for a classic short squeeze, drawing intense participation from retail and momentum speculators.

More About Aneury

In the past, he managed a hefty futures account but lost it due to overconfidence. Aneury then transitioned to stocks with Trade The Pool, trying to learn and adapt to stock trading and the platform quickly. By practicing during the 14-day trial and analyzing losses, he was able to figure out his edge in the markets.

Trade The Pool’s daily pause and other risk management features enabled him to continue learning while avoiding personal capital risk.

Aneury’s Tips

- Fear as a silver lining: “What I learned is you have to trade scared. You have to trade with a sense of protecting your capital before anything else. You have to put risk management number one.”

- Taking profits earlier: “If I’m already in profit before the market closes or heading into the next day’s open, I get eager. I watch the candles closely, and if I see price approaching a support zone or retracing, I usually take profit before that move happens.”

- Cutting losses quickly: “If the chart shows the stock won’t move my way, and I’m already down, I close the trade and move on to the next.”

Funded Trader, Aneury D. – Closing Thoughts

Anuery’s journey highlights that even if the market beats you early on, one must not give up. Continue to hone and pursue your edge, even if it means trading a completely different asset. That persistence could be the difference.

He has $25,000 in buying power.

If you liked this post make sure to share it!