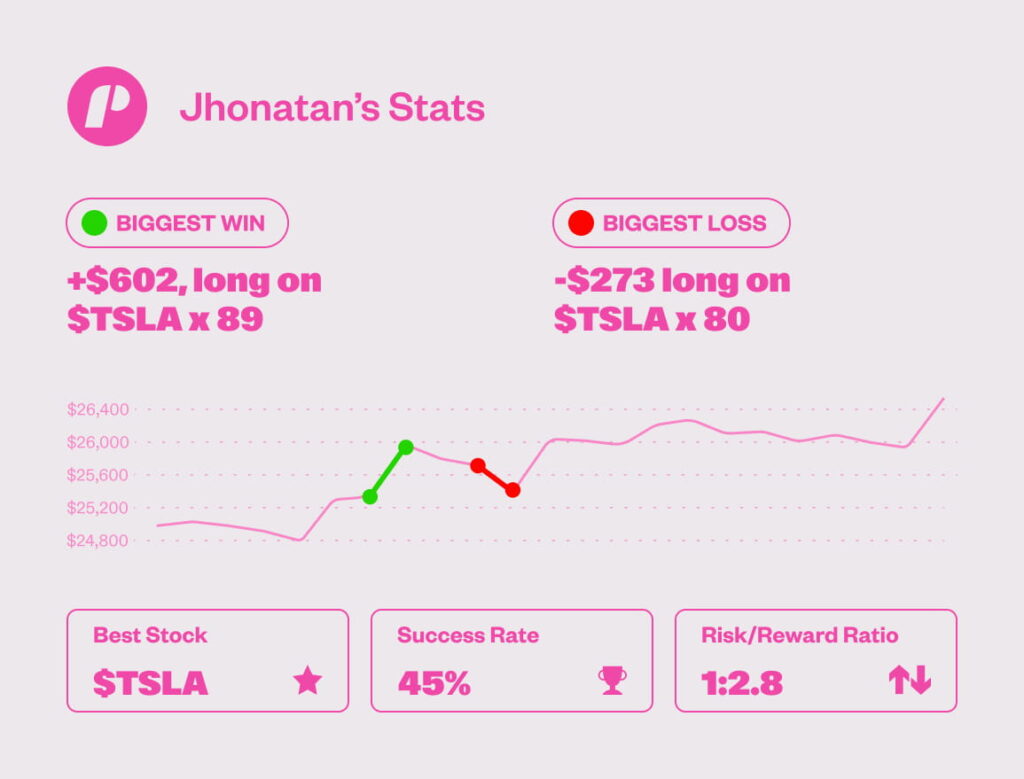

“I’ve been trading my capital since 2023. I tried some prop firms, but trading FX proved to be tougher than expected. Then, I discovered Trade The Pool!”— Welcome to another exciting Trade The Pool funded trader interview!— Today, we spotlight Jhonatan C., a $25,000 funded trader from Brazil. Jhonatan aced his evaluation in just four days, achieving a 45% win rate with a 2.8 risk-to-reward ratio through his expertise in Jhonatan trend trading, focusing on large-cap stocks. Dive into Jhonatan trend trading strategy below, where he leverages price action, moving averages, and volume analysis to capture actionable market moves.

Could you be Trade The Pool’s next funded trader?

Understandding the Jhonatan Trend Trading— The Interview

Jhonatan Trend Trading Style

Jhonatan excels in Jhonatan trend trading, specializing in large-cap stocks like Tesla for their strong liquidity and predictable price action. Specifically, he builds trades around volume analysis, key support and resistance levels, and moving averages to identify sustained trends rather than fleeting fluctuations.

Unlike scalpers, Jhonatan holds positions for several hours, capturing extended price movements with a 1:2 to 1:3 risk-reward ratio. Moreover, his multi-timeframe analysis ensures his Jhonatan trend trading approach aligns perfectly with market trends.

What Moved Tesla Inc ($TSLA) during May 1, 2025

On May 1, 2025, Tesla’s stock surged as Elon Musk scaled back involvement in government projects to refocus on Tesla. Additionally, easing U.S.-China trade tensions and potential tariff reductions on imported components fueled Tesla’s rally amid a broader market upswing, aligning well with Jhonatan’s trend trading strategy.

More About Jhonatan

Jhonatan began trading stocks in 2023, initially facing heavy losses—sometimes up to $1,000 a day. His forex experience with The5ers, Trade The Pool’s sister platform, taught him valuable lessons. However, the volatile currency markets prompted him to shift to stocks, where Jhonatan trend trading found its true home.

He embraced Trade The Pool as an innovative way to trade without risking personal funds, allowing him to focus purely on strategy and execution. Consequently, he now champions Trade The Pool as a platform for traders to hone their trend trading skills and build emotional resilience.

Know More About the Jhonatan Trend Trading— Core Tips

-

Try again tomorrow: “When trading feels off, and your strategy isn’t clicking—you buy, hit a stop, sell, hit another stop—it’s time to step back. Even if I haven’t reached my daily stop loss, I’m done for the day to avoid stress.”

-

Know your limit: “With a $200,000 account, I don’t aim for a 1% gain daily—it’s unrealistic. Instead, I target $500 a day with a $250 stop loss, keeping my Jhonatan trend trading disciplined.”

-

Price action and Tesla: “My trend trading relies on price action. Stocks are easier than indices for this. Volume, support, and resistance, paired with moving averages, drive my decisions. Tesla’s high trading volume makes it ideal for solid trades, even midday.”

Funded Trader, Jhonatan C. – Closing Thoughts

Jhonatan’s success highlights how Jhonatan’s trend trading strategy, aligned with his unique style, combines with determination to drive results.

Trade The Pool empowers traders to refine execution, manage risk, and build consistency—all without the burden of personal capital losses. Join now and start your journey to funded trading success!

If you liked this post make sure to share it!